Home > Media News >

Source: https://www.bloomberg.com

Chinese live-streaming titans YY Inc. and Momo Inc. are among the best performers in the Asian technology universe. Yet investors say they still look cheap and have room to run, despite the uncertainty that pervades the nation’s tightly policed media.

Live-streaming has exploded alongside mobile internet use and ultra-fast wireless adoption in the world’s largest telecommunications arena. It’s a phenomenon driven by the hundreds of millions who’ve migrated to cities from the countryside and -- seeking a human connection -- tune in daily to watch self-styled online personalities eat, cook and apply make-up.

That’s fueled torrid revenue growth for the two players, which take a cut whenever viewers tip their favorite celebs: Momo doubled sales in 2017. Despite the real risk of a regulatory crackdown or burgeoning competition from the likes of Tencent Holdings Ltd. -- the original social media titan -- every analyst but two that covers the companies recommend buying in.

“It’s very difficult for Western investors to wrap their heads around it,” said Dawid Krige, chief investment officer of Cederberg Capital, who holds YY and runs the top-performing Greater China stock fund over the past year. “Companies like YY have been able to develop very good software in real time to both be able to ensure compliance but aren’t impacting the user experience.”

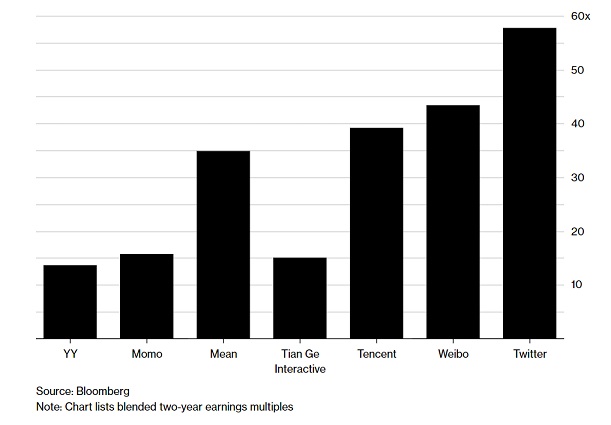

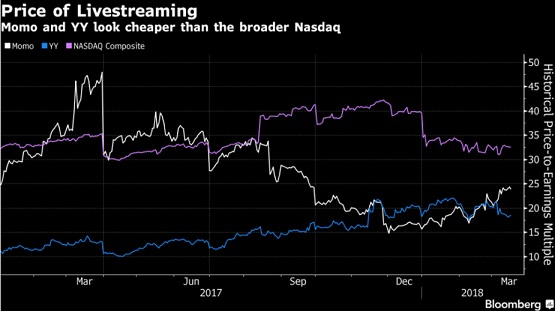

U.S.-listed Momo -- which started out as a Tinder clone -- has tripled over the past two years while YY’s doubled. The former has outpaced every other company in the MSCI Asia-Pacific Information Technology Index in 2018. Yet both trade at price-earnings multiples well below their social media peers, and the Nasdaq itself. YY and Momo are at a mere 0.7 and 0.2 times price-earnings to growth, respectively, versus the 1.3 of Twitter-like Weibo Corp., according to data compiled by Bloomberg. Analysts’ average12-month targets suggest both still have at least 20 percent to rise.

Why Millions of Chinese Stream Reality Shows Starring Themselves

Still a Bargain?

Despite a record rally, Momo and YY still look cheap compared with their global peers.

Chinese live-streaming dwarfs efforts by the likes of Twitter Inc. to popularize the medium in the U.S. Underscoring the potential, Tencent has invested $462 million in YY’s games-streaming subsidiary Huya -- a prime driver of its user expansion. Momo too is hungry for growth, acquiring dating app Tantan Ltd. to complement its streaming services.

But Chinese live-streaming comes with unique risks, chief among them unprecedented competition: YY and Momo are among the largest of the hundreds of streaming services that at one point sprang up across the country, taking advantage of low barriers to entry.

“The competitive landscape is going to be very fierce in 2018,” said Shawn Yang, executive director with Blue Lotus Capital Advisor Ltd. and the only analyst with a Hold rating on YY. While he’s positive about its management and strategy, Yang warns that keeping fickle users hooked on social media is a constant struggle. “They’re also finding it challenging to attract a new generation of young people. The core user’s age for YY is 30 years old so that’s a new challenge. Most of the young people go to Douyin and Kuaishou.”

YY declined to comment while Momo representatives didn’t respond to requests for comment.

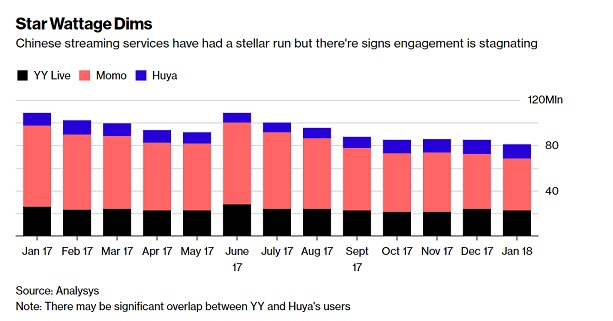

Star Wattage Dims

Chinese streaming services have had a stellar run but there're signs engagement is stagnating

Then there’s the danger that Beijing, wary of the potential for media to undermine its authority, may curtail their growth. In 2017, regulators went after some services that became notorious for sexually-suggestive videos, spurring a ban on, among other things, women eating bananas. But some argue such aggressive policing actually helps the leaders.

“VCs and private equity players are quite sensitive to regulations so when the new rules kicked in, they immediately stopped giving certain funds to the live-streamers and that was a big blow to companies that had not listed,” Nomura analyst Jialong Shi said. “The market has yet to fully appreciate the growth potential for these two live-broadcasters and there’s still room for growth in terms of both business and share prices.”

Also, their perch atop investor wish-lists won’t last forever. YY and Momo enjoy scarcity value because they’re the only listed pure live-streaming apps, but several up-and-comers may debut soon. Beijing-based Inke is said to be raising hundreds of millions of dollars before a Hong Kong listing. Though Tencent owns a slice of YY’s Huya, it’s reportedly poured $630 million into Douyu, another potential debutante. Two media startups valued at more than $10 billion -- Kuaishou and Toutiao -- host more monthly active users than YY and Momo.

Top Stories